Arriving at your shop or office only to discover that it’s been burgled is, to say the least, a very traumatic experience. Fortunately, you’re well prepared. You have a solid insurance policy covering your livelihood against such eventualities. You’ve paid your premiums on time, year after year. That’s the good news. The bad news is that the ensuing insurance claim you’re about to make will more often than not be fraught with so many difficulties that the stress of the burglary will appear a mere trifle by comparison.

So often the written statement that insurance loss adjusters demand of you regarding the circumstances of the burglary leaves you, the innocent victim, feeling like the criminal rather than the victim. The onus of proving ownership and its value will always rest with you, and if you don’t have the receipts and valuations to back up your claim, then there is every possibility that your Insurers will not pay you out.

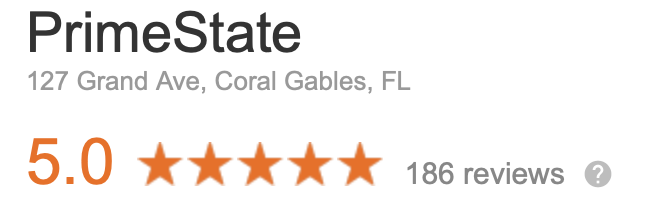

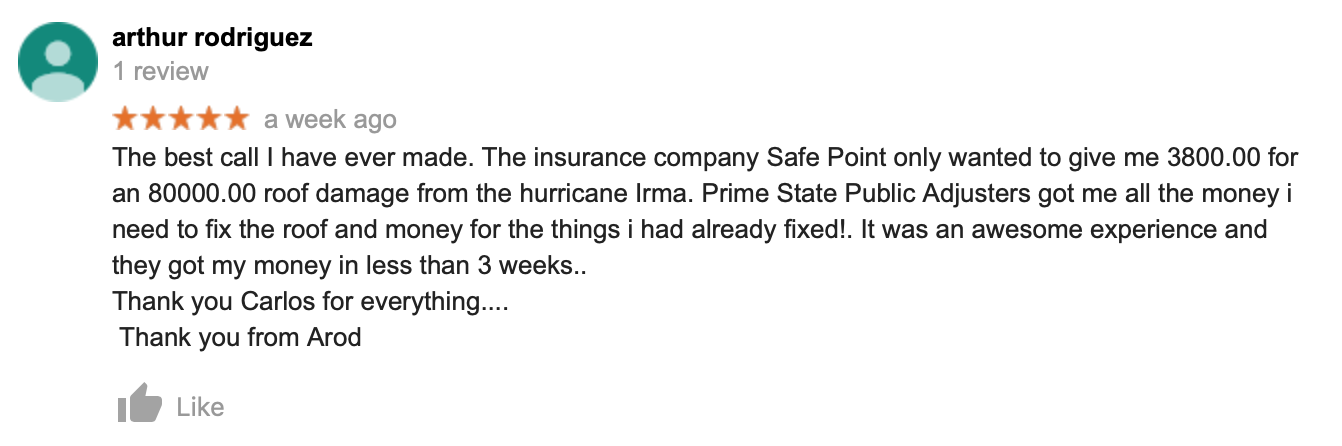

At Prime State Public Adjuster Miami Assessors, it’s simple; we guarantee to get you every single penny you are due. No win, no fee.

ALL YOU NEED TO KNOW ABOUT BURGLARY CLAIMS

Your insurance company will instruct a firm of Loss Adjusters to act on their behalf. While the adjuster will insist upon being independent and impartial on the matter, the reality says otherwise. The firm is being paid by the insurance company and is there to represent their best interests. As far as the insurers are concerned, the loss adjuster doing a good job means reducing the final settlement as much as possible and, ideally, enabling them to decline cover entirely.

Even in situations where you stand a good chance of eventually receiving the settlement, you’re entitled to, the proverbial obstacle course you’ll have to navigate is a daunting and demoralizing one. You’ll be bombarded with a barrage of seemingly irrelevant questions about the crime over various meetings and will have to produce pages worth of schedules of stolen items and statements. And that’s not the end of it. Quite frequently, if you cannot produce substantiating evidence for all of the claimed items, the adjuster will try to decline cover for them or at least substantially reduce the payout. Even where you have the best of proofs, there still may be attempts to cast further doubt on the matter.

Of course, in-home burglaries, there are other losses that go beyond the mere cost of the stolen goods, namely the financial consequences for your business. Although the premises may be intact, without crucial business items you will not be returning to “business as usual” anytime soon. You will have to claim for these financial losses and, once again, particularly in the current economic climate, your insurers will seek out every avenue that may enable them to accuse you of failing to comply fully with the policy and to repudiate your claim.

As Loss Assessors, our function is to represent your best interests. We are experts in claim negotiation and can ensure that you get the very best settlement possible under your policy. We will manage your entire claim from start to finish, taking all of the stress and burdens away from you and ensuring the claim is not put in jeopardy due to one or two simple errors.

We work on a “no win – no fee” basis in which our fee is calculated as a percentage of your final settlement. This means that negotiating a bigger settlement for you equates to a bigger payment for us. There could be no better incentive to do the very best job for you that we possibly can. We’re on your side.

FREQUENTLY ASKED QUESTIONS

I’VE JUST ARRIVED AT MY PLACE OF WORK AND WE HAVE BEEN BURGLED. I’M ABOUT TO MAKE AN INSURANCE CLAIM. IS THERE ANYTHING I SHOULD DO BEFORE TELEPHONING MY INSURANCE COMPANY?

In the unlikely event that you haven’t done so already, please telephone the local police and request a crime reference number. This is vital and will be requested by your insurers. Then contact a locksmith or glazier to secure the point of intruder entry.

WHAT DO I TELL THE POLICE WHEN THEY ASK ME TO LIST EVERYTHING THAT HAS BEEN STOLEN FROM MY SHOP/OFFICE/FACTORY?

Quite obviously, you are very unlikely to be able to make a full and comprehensive list of all the items that have been stolen from your workplace and this is something you must make very clear on any small schedule of the main items that have been stolen that this is simply a temporary list pending your staff conducting a full stock check.

It is not a rare occurrence when we find that factory/shop/office victims of burglary are far too quick to pass the police or their insurers what they believe to be a total list of everything that has been stolen without giving any explanation that the schedule had been drawn up in a rush without having made a detailed stock check. It can often take a week or two (sometimes more) to discover other unobvious items that were stolen and when these extra items are sent to the police your insurers treat your burglary claim as a suspect. When the Loss Adjuster does feel that a theft claim is worthy of further “forensic examination/investigation” by their specialist teams, this will have a great and ominous effect in the subsequent administration of the claim. At the risk of repetition, all of this could have been avoided by simply writing those few words, “This is a temporary list of those items that we can immediately see have been stolen and will be subject to a complete inventory after we have carried out a full stock check”.

IF YOU HAVE ANY FURTHER QUESTIONS, PLEASE DON’T HESITATE TO CONTACT A PROFESSIONAL PUBLIC ADJUSTER FOR A FREE CONSULTATION AT (201) 347-0611