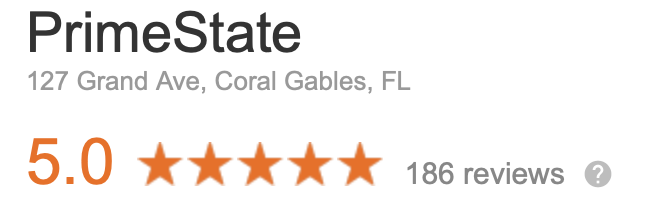

Prime State Public Adjusters Miami Assessors have dealt with thousands of home flood insurance claims over 30-years and no other firm is more qualified to help you through such a disaster. It is absolutely vital that you call us immediately after the flood because it is the first few days that are so often critical to making a successful water damage claim.

At Prime State Public Adjusters Miami Assessors, it’s simple, we guarantee to get you every single penny you are due. No win, no fee.

ALL YOU NEED TO KNOW ABOUT FLOOD CLAIMS

The insurance company will send a loss adjuster to visit you within 24hrs so that they can report back to the insurance company with their findings. We also need to note these important initial findings which, in some cases, can prove to be the difference to your water damage claim being met or refused.

So often, the biggest damage to a flood affected property is not the actual water damage itself but the damage to the fabric of the building caused by incorrect drying-out of the property.

For example, before installing dehumidifiers to dry out the property, it is essential that following water contamination you ensure that the correct chemical sanitisation is carried out after you strip out all of the furniture. You then have to make sure that the correct anti-fungal treatments are used so as to ensure that dry or wet rot isn’t given the chance to take hold in the future.

Only after these procedures have been carried out should you install dehumidifiers and even then it is vital that the dehumidifiers are not so powerful so as to cause significant shrinkage to the building fabric.

Our expert Assessors are on your side and will ensure that we quickly help you find alternative living accommodation. We will coordinate all aspects of your claim and ensure that we get every last penny to which you are entitled.

A BURST PIPE HAS JUST FLOODED MY HOME AND I’M ABOUT TO MAKE AN INSURANCE CLAIM. WHAT SHOULD I DO BEFORE TELEPHONING MY INSURANCE COMPANY?

Firstly, because you are reading this we are going to assume that you’ve already called a plumber. Make sure that you turn off the stop-cock (often underneath the kitchen sink). Also, switch off the electricity to those areas of your house/flat that have been affected by the water ingress. When you experience a burst pipe for the first time you literally do not know which way to turn. We find that the vast majority of burst pipe insurance claims happen because the pipes are uninsulated. In fact, we have had instances over the years where the Loss Adjuster does everything possible to try to repudiate a burst pipe claim when he sees no lagging and advises the insurance company either not to pay or to severely restrict the eventual pay-out. On the off-chance that you are reading this paragraph by way of interest and not that you are about to make a domestic burst pipe claim, we can do no better than to strongly advise you to ensure that all of the pipes in your home are fully lagged. It is a very inexpensive and quick procedure that could save you much heartache during the winter months.

If you live in a flat or a large apartment block and you don’t have control of the water supply, then contact your landlord or Managing Agents immediately.

I’VE NEVER HAD A FLOOD BEFORE, HOW DO I MAKE AN INSURANCE CLAIM FOR WATER DAMAGE?

When you telephone your insurance company, ask for the claims department and explain to them that you have had serious water damage at your home and need their instructions. In all likelihood, they will instruct a Loss Adjuster who will represent their interests (not yours!) and he will make an appointment to come and see you. Quite obviously, if it is a very serious flood then pressure the claims department to instruct a Loss Adjuster immediately and tell them that you cannot wait (especially if you have young children or are caring for the elderly).

This is also the ideal time to instruct Loss Assessors (ideally us!) insofar that where possible, we would like to meet you before you meet your Insurance Company’s representative, the Loss Adjuster. This gives us the opportunity to acquaint ourselves with your home and ensure that whatever report the Loss Adjuster writes to your insurers will be exactly as we have found it ourselves. Please note that our meeting you before you meet the insurance company’s Loss Adjuster is not essential but it very much helps.

It is essential to understand that when you are making an insurance claim for flood or water damage, it is paramount that you do everything possible to mitigate (minimize) your loss. If your insurers believe that you have not acted promptly and with due diligence they can quite easily suggest that the water damage is far more severe than it would’ve been had you attended to the situation quicker.

WHAT WILL Prime State Public Adjusters Miami ASSESSORS DO AS SOON AS THEY ARE INSTRUCTED TO HANDLE MY DOMESTIC INSURANCE CLAIM?

The first thing we will do is to instruct a specialist flood/water damage restoration company who we know will be acceptable to your insurers. Many ‘so-called’ restoration companies take advantage of an emergency flood/water ingress insurance claim and charge an unacceptably large fee, which will immediately put your insurance company ‘on its guard’ for the rest of the claim.

We will also instruct an electrical contractor on your behalf who will have had a great deal of experience with insurance claims and wet wiring. It’s important to note that not all electrical contractors have insurance claims experience and we can confirm that our approved list of electrical contractors are all insurance company approved. Be mindful that even when your property looks dry, so often the after-effects of water ingress can go far beyond what can actually be seen. It is vital that every square inch (OK, centimeters for you younger folk!) of your property is fully dried out. By way of an example, should it be found after a few years that your property has wet rot that can be linked to the original water damage claim, then your insurers are very likely to repudiate the future wet rot claim. Also, if your property has been very badly damaged by the water ingress and requires you and your family to seek alternative accommodation, then we will ensure that the restoration company pumps out all excess water and installs drying equipment, making sure that your home is left totally secure.

IF YOU HAVE ANY FURTHER QUESTIONS, PLEASE DON’T HESITATE TO CONTACT A PROFESSIONAL PUBLIC ADJUSTER FOR A FREE CONSULTATION AT (201) 347-0611