CALL FOR FREE CLAIM REVIEW (201) 347-0611

Best Business Fire Claims Public Adjuster New Jersey NY

Having a fire at your shop or office is, to say the least, a very traumatic experience. Fortunately, you’re well prepared. You have a solid insurance policy covering your livelihood against such eventualities. You’ve paid your premiums on time, year after year. That’s good news. The bad news is that the ensuing insurance claim you’re about to make will more often than not be fraught with so many difficulties that the stress of the fire will appear a mere trifle by comparison.

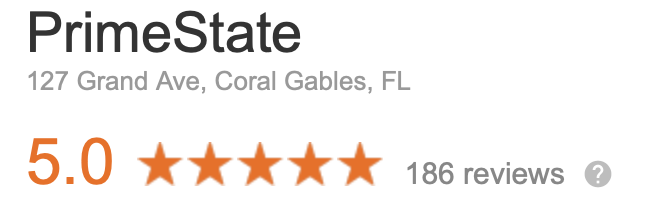

Your insurance company will do everything they can to avoid paying you out of your full entitlement. Prime State Public Adjusters Miami Assessors have successfully settled thousands of fire claims in the last 30 years, and no other firms of loss assessors are more qualified to help you through such a disaster.

At Prime State Public Adjusters Miami Assessors, we have dealt with thousands of business fire insurance claims over 30-years. We guarantee to get you every single penny you are entitled to. No Win, No Fee!

ALL YOU NEED TO KNOW ABOUT FIRE CLAIMS

Your insurance company will instruct a firm of Loss Adjusters to act on their behalf. While the loss adjuster will insist upon being independent and impartial on the matter, the reality says otherwise. The firm is being paid by the insurance company and is there to represent their best interests. As far as the insurers are concerned, the loss adjuster doing a good job means reducing the final settlement as much as possible and, ideally, enabling them to decline cover entirely.

Even in situations where you stand a good chance of eventually receiving the settlement you’re entitled to and having your premises restored to the pristine condition it was in before the disaster occurred, the proverbial obstacle course you’ll have to navigate a daunting and demoralizing one. You’ll be bombarded with a barrage of seemingly irrelevant questions spanning across various meetings and will have to produce pages worth of schedules of damaged items. You may be required to obtain a quote after quote from contractors before it is decided that you can even think about proceeding with repairs. And that’s not the end of it. Quite frequently, if you cannot produce substantiating evidence for all of the damaged items, the loss adjuster will try to decline cover for them or at least substantially reduce the payout.

Of course, in business fires, it is not merely a question of having the premises repaired and replacing ruined stock. Your business has probably been rendered entirely inoperable, and the financial consequences of this are tremendous. You will have to claim for the losses accruing from the interruption to your business, and this often involves claiming for temporary relocation to alternative business premises while repairs are being undertaken. Once again, and particularly in the current economic climate, your insurers will seek out every avenue that may enable them to accuse you of failing to comply fully with the policy and to thereby repudiate your claim.

As Loss Assessors, our function is to represent your best interests. We are experts in business fire insurance claims negotiation and can ensure that you get the very best settlement possible under your policy. We will manage your entire claim from start to finish, taking all of the stress and burdens away from you and ensuring the claim is not put in jeopardy due to one or two simple errors.

We work on a “no win, no fee” basis in which our fee is calculated as a percentage of your final settlement. This means that negotiating a bigger settlement for you equates to a bigger payment for us. There could be no better incentive to do the very best job for you that we possibly can. We’re on your side.

I’VE HAD A FIRE AT MY BUSINESS PREMISES AND I’M ABOUT TO MAKE AN INSURANCE CLAIM. IS THERE ANYTHING I SHOULD DO BEFORE TELEPHONING MY INSURANCE COMPANY TO REPORT IT?

Before calling your insurers, do everything you would do if you were not insured. Get a damage control company to come round and secure any broken windows and fire damaged doors to ensure that your workplace remains secure. If your shop/offices/factory is very badly damaged, do everything to retrieve anything of important commercial value including computer data, business files and anything else essential to the continued best running of your business.

When you are satisfied that you have retrieved everything possible then telephone your insurers or your insurance broker to report the incident and it is vital that you take the name and department of the person you speak to. They will undoubtedly employ a Loss Adjuster to meet you at your place of work and, again, if the damage is particularly serious, they will advise you as to making plans for finding alternative business premises whilst the building is being rebuilt/refurbished/redecorated. Do not make the mistake that over 90% of claimants make in believing that the Loss Adjuster has been sent to meet you by the insurance company to help you make and compile your claim. For the avoidance of doubt, it is vital that you understand that the Loss Adjuster is being employed by the Insurance Company to represent their interests, although under charter, they are purportedly independent. Regretfully, that independence will quickly prove to be one-sided.

I’VE NEVER HAD A FIRE AT MY BUSINESS PREMISES BEFORE… CAN YOU GIVE ME ANY TIPS AS TO HOW TO MAKE A COMMERCIAL INSURANCE CLAIM?

After telephoning your insurance brokers or claims department of your insurance company, we would well advise you to telephone a reputable firm of long-established Insurance Loss Assessors (hopefully us!) and, in all likelihood, we will visit your business before the Loss Adjuster gets there in order to give you impartial advice. Prime State Public Adjusters Miami Assessors’ only interest is your business and to put the business back in the same position it was in before the fire.

A good 60% of our clients are repeat business and many of them have used us since the inception of our company in 1998. More often than not, repeat customers telephone us before telephoning their insurers and we are on call 24/7 in the case of emergencies.

You are very likely to find camped outside your business what are commonly termed “ambulance-chasers”, all dying to get you to sign up with them as Loss Assessors. We find this practice abhorrent and Prime State Public Adjusters Miami Assessors have never indulged in this type of “business getting”. These “cowboy” assessors spend much time listening in to the emergency services on shortwave radio and try their luck to sign up the business owner when he/she is at their lowest point. If you are reading this after you have signed up with an “ambulance chaser” and you are regretting your decision, may we remind you that the law is on your side and that you have a 14-day cooling off period to cancel any such contract and to employ any other Loss Assessor of your choice. The only way you will employ Salmon Assessors is by perhaps a friend giving you a recommendation or by searching the internet for ‘Loss Assessors’ or ‘fire insurance claim’ etc.

IF YOU HAVE ANY FURTHER QUESTIONS, PLEASE DON’T HESITATE TO CONTACT A PROFESSIONAL PUBLIC ADJUSTER FOR A FREE CONSULTATION AT (201) 347-0611

CONTACT US NOW

|

|